Emerging Dynamics in Crowdfunding Campaigns

Recent research has shown that, in addition to the quality and representations of project ideas, dynamics of investment during a crowdfunding campaign also play an important role in determining its success. To further understand the role of investment dynamics, we did an exploratory analysis by applying a decision tree model to train predictors over the time series of money pledges to campaigns in Kickstarter to investigate the extent to which simple inflows and first-order derivatives can predict the eventual success of campaigns.

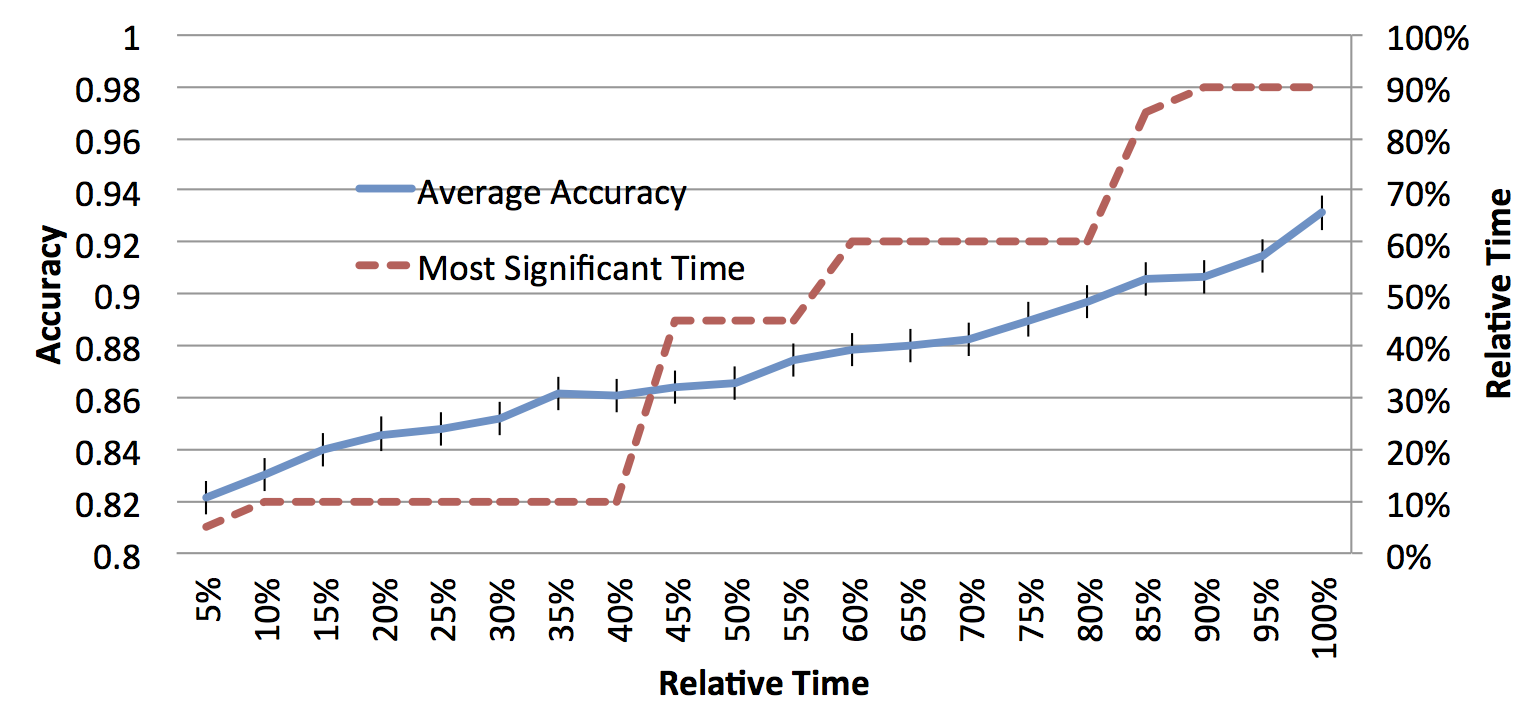

The results based on the the values of money inflows are shown in Figure 1:

- As expected, the performance of the predictors steadily improves.

- With only the first 15% of the money inflows, out predictor can achieve 84% accuracy.

- The most “active” periods could be around the first 10% as well as between the 40-60%.

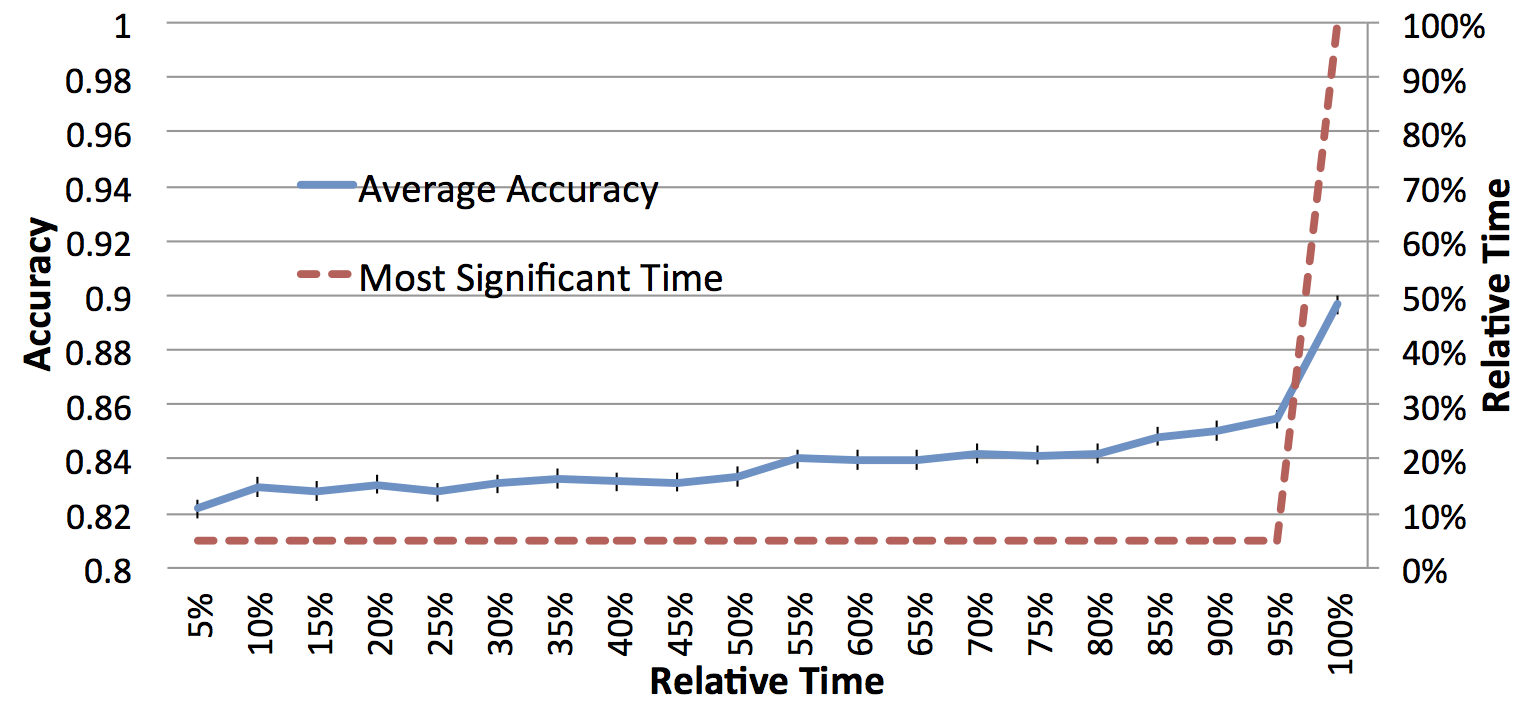

The results based on the the derivative of money inflows are shown in Figure 2:

- The performance of the predictors does not increase much until the very last stage.

- The most important period also does not change until the end, jumping from 5% to 100%.

So according to the above results, we reach the conclusion:

- The periods around 10% and 40%-60% during a campaign had a stronger impact.

- “Seed money” (init 15% money inflow) may probably determine the final result of a campaign.

- Don’t give up and you can still make it at the very end of the campaign.

For more, please see our full paper.

Author List:

- Huaming Rao , Huaming Rao, Nanjing University of Science & Technology and University of Illinois at Urbana-Champaign.

- Anbang Xu , University of Illinois at Urbana-Champaign.

- Xiao Yang, Tsinghua University.

- Wai-Tat Fu , University of Illinois at Urbana-Champaign.